Filed under: Energy, Company News, Industry News, Oil & Gas Industry, Investing

Energy prices are plunging around the world, and consumers are likely in for a winter of lower energy costs. The U.S. Energy Information Administration predicts natural gas heating bills may fall as much as 7.9 percent for consumers in the Midwest, and heating oil costs nationwide may fall an incredible 15.4 percent from just a year ago.

You may think that’s bad news for the companies collecting your energy bill. but most utilities are insulated from the falling cost of energy. They’ll rake in profits regardless.

How a Utility Makes Money Whether Energy Prices Rise or Fall

Most utilities around the country providing electricity and natural gas to homes and businesses operate in a highly regulated environment. Cities and towns don’t want 15 different power lines or natural gas lines running overhead or under our feet, so they allow a utility a monopoly to build infrastructure and provide energy to customers.

In return for this monopoly, utilities agree to only make a certain rate of return on the assets they install, essentially limiting their profits. But this setup also ensures that utilities make money even if you don’t use much energy. Prices they charge to you are set so they generate their expected rate of return, even if energy prices fall.

Yet utilities aren’t the only energy companies that will be making money despite falling energy prices. A segment of the industry called midstream transports energy around the country, and they’re in for a good year as well.

The Tollbooths of Energy

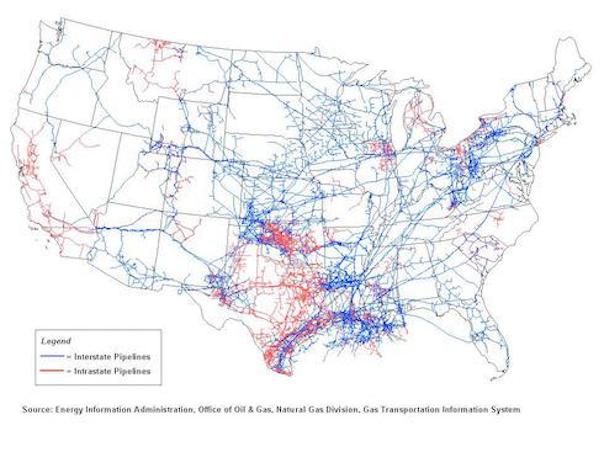

Between the oil and natural gas wells of the U.S. and the homes and businesses that consume energy is a maze of pipelines that transport energy around the country. In many cases, these pipelines follow the interstate network that already zigzags across the country (as you can see in the map below).

But instead of being owned by the government like roads are, energy pipelines in the U.S. are owned by midstream energy companies. Kinder Morgan (KMI) is one of the largest pipeline operators, with 80,000 miles of pipelines moving oil, natural gas, carbon dioxide and other materials around the country. In many cases, these companies don’t collect fees based on the price of oil or natural gas, but instead essentially collect a toll for moving energy.

Midstream energy companies are among the most important in the energy industry, but like electric and natural gas utilities, they’re not all that susceptible to energy price fluctuations. Don’t feel bad for them when prices fall like they have recently. The stability of a company like Kinder Morgan may also be a reason to put the stock on your investment watch list.

Big Oil Will Find a Way

Big oil companies won’t be impacted as you might think, either. These companies dominate energy in the U.S., such as ExxonMobil (XOM), Chevron (CVX), Total (TOT) and Royal Dutch Schell (RDS-A).

Big oil may see drilling, or upstream, profits take a beating, but that’s not all they make money doing. Big oil companies own refineries, chemical plants, gas stations and more in their downstream businesses, and as long as people are using energy, they’ll make profit somewhere along the value stream.

There’s also production of natural gas, which has seen prices recover from lows in 2012. Companies like ExxonMobil have invested heavily in the last decade in expanding natural gas production, and it could now pay off if prices continue to climb.

Of course, there is one danger for big oil that should worry executives and investors alike.

The Biggest Danger to Energy Profits

Profits in the energy industry are largely tied to how regulated a company is and how much of its product consumers are using. In large part, electricity consumption continues to grow slowly but surely, ensuring long-term profit for utilities.

Natural gas usage is also growing slowly, driven by its use to heat homes and the low cost that’s making it attractive to more electricity generators.

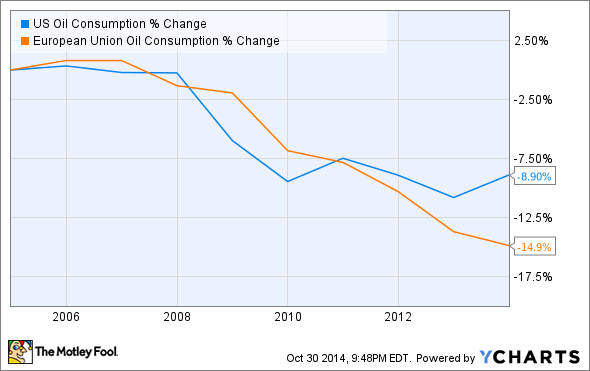

But when oil and gasoline prices fall, the pain is felt closest to the source. And prices are falling: According to GasBuddy.com, the average retail gasoline price in the U.S. has plunged from $3.70 a gallon in late June to around $3 today. This is in part due to greater supply on the market, and a progressive decline in oil and gasoline consumption in both the U.S. and Europe over the past decade.

The drop in gas prices may not impact a lot of companies, such as refiners or pipeline operators, which will also have lower costs because oil is cheaper or profits are regulated. But it will have a big impact on oil drillers. Continental Resources (CLR), Kodiak Oil & Gas (KOG), and EOG Resources (EOG) are just three of the companies that expanded rapidly to exploit U.S. shale oil reserves, and they’ll see revenues drop as a result of lower oil prices. Since drilling costs don’t come down just because oil prices are low, their profits will likely plunge as well.

So keep in mind when you’re paying your energy bills this winter that lower prices aren’t necessarily bad for all energy companies. If they’re not the ones taking the fuel out of the ground, they’ll likely be just fine whatever you’re paying.

Motley Fool contributor Travis Hoium manages an account that owns shares of Kinder Morgan, Royal Dutch Shell CL A and Total (ADR). The Motley Fool recommends Chevron, Kinder Morgan and Total (ADR). The Motley Fool owns shares of Kinder Morgan. Try any of our Foolish newsletter services free for 30 days. To read about our favorite high-yielding dividend stocks for any investor, check out our free report.

Permalink | Email this | Linking Blogs | Comments

Source: Investing