Filed under: Investing

In the last 12 months, AT&T has spent approximately $23.2 billion on capital projects, or 17.78% of its total revenue. That far exceeds the 16.5% and 15.5% of total revenue AT&T directed toward capital expenditures in 2013 and 2012, respectively. So AT&T is clearly making big, aggressive bets on its future, but on what, and are these investments wise?

AT&T has demonstrated in SEC filings and press releases that its operational focus lies in 4G LTE and broadband infrastructure, also called Project VIP,, an initiative that the company announced in 2012 saying at the time that it would invest $14 billion over three years to “significantly expand and enhance its wireless and wireline IP broadband networks to support growing customer demand for high-speed Internet access and new mobile, app and cloud services.” AT&T is also making investments that complement Project VIP, such as fixed network access for businesses and small cell technologies to improve network performance.

According to AT&T, virtually all of its capital expenditures are spent on wireless and wireline networks. The company’s wireless expenditures, which include improvements to data networks, accounted for 52% of total spending last year. The remaining 48% was spent on wireline, including broadband and U-verse during 2013. Importantly, AT&T guided that the ratio for wireless and wireline spending would be “proportionally consistent” this year versus 2013.

Let’s look at where AT&T is putting money to work, and whether those investments will pay off and make AT&T a good investment opportunity.

Making wireless improvements to catch Verizon

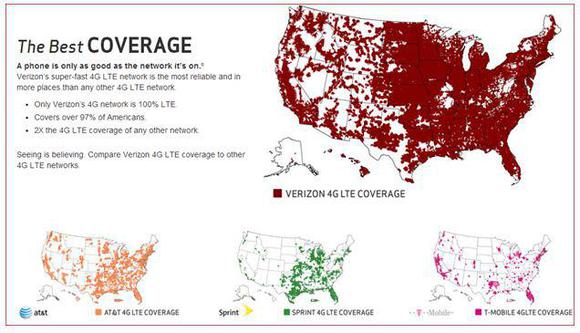

AT&T spent approximately $11.8 billion during the first six months of 2014 on capital projects, much of which was tied to the company’s 4G LTE buildout, or wireless expenditures. This is an initiative to cover the entire U.S. and offer more 4G-related services, like Verizon has done, to further improve AT&T’s wireless services segment, which makes up nearly 50% of total company revenue.

Source: Verizon.

AT&T famously boasts the nation’s “best” 4G network, and Verizon undoubtedly has the largest network by covering 97% of Americans. As a result, Verizon has been able to combine its data and voice services, also called VoLTE, onto one high-performance 4G LTE network. Meanwhile, AT&T is still building its network to offer similar services , essentially playing catch-up to Verizon.

Infonetics Research expects the VoLTE market to grow 145% annually until 2017, at which point it will be valued at $17 billion. The reasons for this growth likely lie in the benefits of VoLTE, which include better connectivity, improved call quality, reduced battery drain, and high-definition video talk. With Verizon offering nationwide VoLTE services, and with 4G networks being 10 times faster than older 3G networks, making large investments in 4G is important for AT&T. The company expects its 4G network construction to be complete by early next year.

Fighting off Google

Last year, AT&T’s broadband internet business accounted for 10% of the company’s $128.7 billion in total revenue, after growing 25% compared to 2012. Broadband has quickly become an important business for AT&T, a growth engine, and a market made highly competitive by demand for faster speeds and broad coverage.

AT&T’s most significant broadband investments can be separated into two segments: its GigaPower service and fixed network access for business customers, including free Wi-Fi. AT&T has launched the GigaPower fiber network in a few cities, and plans to launch the service in 100 additional cities in the near future. GigaPower’s current speed of 300 megabits per second, or Mbps, is 30 times faster than the average broadband speed. However, Google‘s competing Fiber service has seen impressive demand and offers speeds up to 1 gigabit per second, or Gbps, which is 100 times faster than the average broadband. In response, AT&T announced earlier this year its plan to increase broadband speeds from 300 Mbps to 1 Gbps in order to compete with Google.

With AT&T cutting the prices of its mobile plans and with broadband being its biggest growth driver, such broadband investments are necessary. While AT&T hasn’t said specifically how much it will spend on GigaPower’s infrastructure and construction, it is probably a substantial amount as Google Fiber’s buildout construction is estimated to be quite costly. In fact, Goldman Sachs has estimated that if Fiber were to reach 50 million households, less than half of all U.S. homes, Google might have to spend as much as $70 billion.

A never-ending cycle

That said, AT&T has countless other projects that could become a big part of AT&T’s long-term future. One is maximizing the use of spectrum with small cells in the face of increased data use and FCC restrictions on how much spectrum a company can own in a specific region. Another is the planned acquisition of DIRECTV to pave a way into emerging markets such as Latin America.

AT&T’s capital expenditures are certainly warranted given the competition it faces in key industries. With GigaPower still in the early stages of development, investors can expect continued investments while other projects like 4G LTE are completed. New projects like 5G and maximizing the synergies between DIRECTV and AT&T might also become relevant capital expenditures, demonstrating the never-ending investments in the telecom space.

Foolish thoughts

In AT&T’s most recent annual report, the company did say that 2014 would be a peak investment year, and that its capital investments will soon trend back toward historic levels following the completion of Project VIP. The problem, according to research firm BTIG, is AT&T’s reduction of service prices for consumers could result in a 5% decline in total revenue during the next two quarters, and also cause long-term pressure on its average revenue per user. Meanwhile, Verizon’s decision to limit price cuts should result in a low-to-mid-single-digit growth rate.

All things considered, AT&T’s spending exceeds while its revenue growth lags its primary competitor. While AT&T’s capital expenditures might decline after 2014, the uncertainty surrounding its revenue per user and future margins are most certainly a concern. If aggressive pricing plans do eventually weigh on AT&T’s top and bottom line, it would be hard to call the stock a good investment opportunity, or a company whose capital investments will decline as a percentage of total revenue. It might be best to watch, but not invest in AT&T until these current capital investments are complete and the company’s performance can be further assessed.

Your cable company is scared, but you can get rich

You know cable’s going away. But do you know how to profit? There’s $2.2 trillion out there to be had. Currently, cable grabs a big piece of it. That won’t last. And when cable falters, three companies are poised to benefit. Click here for their names. Hint: They’re not Netflix, Google, and Apple.

var FoolAnalyticsData = FoolAnalyticsData || []; FoolAnalyticsData.push({ eventType: “ArticlePitch”, contentByline: “Brian Nichols”, contentId: “cms.146290”, contentTickers: “”, contentTitle: “Is AT&T Making Wise Bets on Its Future?”, hasVideo: “False”, pitchId: “482”, pitchTickers: “”, pitchTitle: “”, pitchType: “”, sfrId: “” });

The article Is AT&T Making Wise Bets on Its Future? originally appeared on Fool.com.

var ord = window.ord || Math.floor(Math.random() * 1e16);

document.write(‘x3Cscript type=”text/javascript” src=”http://ad.doubleclick.net/N3910/adj/usdf.df.articles/articles;sz=5×7;ord=’ + ord + ‘?”x3ex3C/scriptx3e’);

Brian Nichols owns shares of Verizon Communications. The Motley Fool recommends Google (A shares) and Google (C shares). The Motley Fool owns shares of Google (A shares) and Google (C shares). Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 – 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.

(function(c,a){window.mixpanel=a;var b,d,h,e;b=c.createElement(“script”);

b.type=”text/javascript”;b.async=!0;b.src=(“https:”===c.location.protocol?”https:”:”http:”)+

‘//cdn.mxpnl.com/libs/mixpanel-2.2.min.js’;d=c.getElementsByTagName(“script”)[0];

d.parentNode.insertBefore(b,d);a._i=[];a.init=function(b,c,f){function d(a,b){

var c=b.split(“.”);2==c.length&&(a=a[c[0]],b=c[1]);a[b]=function(){a.push([b].concat(

Array.prototype.slice.call(arguments,0)))}}var g=a;”undefined”!==typeof f?g=a[f]=[]:

f=”mixpanel”;g.people=g.people||[];h=[‘disable’,’track’,’track_pageview’,’track_links’,

‘track_forms’,’register’,’register_once’,’unregister’,’identify’,’alias’,’name_tag’,

‘set_config’,’people.set’,’people.increment’];for(e=0;e<h.length;e++)d(g,h[e]);

a._i.push([b,c,f])};a.__SV=1.2;})(document,window.mixpanel||[]);

mixpanel.init(“9659875b92ba8fa639ba476aedbb73b9”);

function addEvent(obj, evType, fn, useCapture){

if (obj.addEventListener){

obj.addEventListener(evType, fn, useCapture);

return true;

} else if (obj.attachEvent){

var r = obj.attachEvent(“on”+evType, fn);

return r;

}

}

addEvent(window, “load”, function(){new FoolVisualSciences();})

addEvent(window, “load”, function(){new PickAd();})

var themeName = ‘dailyfinance.com’;

var _gaq = _gaq || [];

_gaq.push([‘_setAccount’, ‘UA-24928199-1’]);

_gaq.push([‘_trackPageview’]);

(function () {

var ga = document.createElement(‘script’);

ga.type = ‘text/javascript’;

ga.async = true;

ga.src = (‘https:’ == document.location.protocol ? ‘https://ssl’ : ‘http://www’) + ‘.google-analytics.com/ga.js’;

var s = document.getElementsByTagName(‘script’)[0];

s.parentNode.insertBefore(ga, s);

})();

Read | Permalink | Email this | Linking Blogs | Comments

Source: Investing