Filed under: Stock Picks, Tobacco, Wall Street Watch, Stocks, Investing

CVS Health’s (CVS) move this month to stop selling tobacco products in its 7,700 retail locations might seem like a win for anti-smoking advocates, but it may be a big loss for CVS shareholders.

Pundit Jim Cramer had this comment in Feburary after the initial bump in CVS stock price following the announcement. “This is not a market that’s saying, ‘You know what? I am going to buy CVS because they are good citizens.’ It just doesn’t work like that. That’s a nice world, like Oz. Oz is terrific. It might make money in Oz, but Wall Street is not Oz.”

Though Cramer swears he has never smoked a cigarette, he says he is not in the business of telling people how to lose money, and he feels that cutting out tobacco sales will hurt CVS shareholders.

Many Synonyms for Sin

Both the decision and Cramer’s reaction highlight a long-running debate among investors: Should right-minded investors buy “sin” stocks? Typically these are companies involved in what can be considered immoral or unethical activities, the most well-known being tobacco-related companies like Altria (MO), Philip Morris (PM) or British American Tobacco (BTI).

But of course, avoiding sin stocks is not as easy as just staying away from tobacco companies.

According to the federal National Institute on Alcohol and Alcoholism, 17 million adults in the U.S. have alcohol-use disorders. Almost 88,000 people die annually from alcohol-related causes — not including drunk driving — making drinking the third-most-preventable cause of death. In addition, the Centers for Disease Control have estimated that alcohol misuse costs the U.S. $223.5 billion each year.

So if you’re avoiding sin stocks, then Anheuser-Busch InBev (BUD), Molson Coors (TAP), Diageo (DEO) and about 20 other alcohol-related companies should certainly be on your “don’t buy” list.

Gambling and Guns

How do you feel about gambling? Statistics estimate there are 2 million pathological gamblers and 4 million to 6 million problem gamblers in the U.S. If that bothers you, then you might want to take Ceasers Entertainment (CZR), Las Vegas Sands (LVS), Wynn (WYNN) and similar stocks off your “buy” list.

Have an issue with guns? There goes Smith & Wesson Holdings (SWHC) and Sturm, Ruger & Co. (RGR).

Feel like there is too much war in the world? Might want to avoid Northrup Grumman (NOC), United Technologies (UTX) and Raytheon (RTN), all of whom have huge contracts with the military.

Depending on what your definition of “unethical and immoral” is — and how true you are to your beliefs — the list might include these sectors and companies:

- Finance (high-interest loans to low-income consumers): EZCorp. (EZPW), Cash America International (CSH) and World Acceptance (WRLD).

- Fast food (high-calorie food contributing to the obesity epidemic): McDonald’s (MCD), Burger King Holdings (BKW) and Yum! Brands (YUM).

- Medicine (contraceptives that offend some religious beliefs): Pfizer (PFE), Eli Lilly (LLY) and Church & Dwight (CHD).

- Crime (construction and management of U.S. prisons): Corrections Corp of America (CXW), The GEO Group (GEO) and Avalon Correctional Services (CITY).

- Soft drinks (sugary beverages possibly linked to increase in childhood diabetes): Coca-Cola (KO), Pepsico (PEP) and Dr Pepper Snapple Group (DPS).

- Sex (strips clubs, pornography and Internet hook-up sites): Private Media (PRVT) and Rick’s Cabaret International (RICK)

And if you look hard enough at almost any company, it can have a connection to a potentially “sinful” activity, from the way that Starbucks (SBUX) gets its coffee beans to the way the Goldman Sachs (GS) underwrote subprime mortgages.

Sorry, but Wall Street Doesn’t Care

Though the desire for investors to be socially responsible is admirable one, Wall Street and the stock market are amoral: unconcerned about matters of “good” or “bad,” and solely focused on what’s profitable. And the irony is that the underlying companies of most sin stocks are quite profitable.

By their nature, the products these types of companies produce tend to draw a steady stream of customers, even in bad economic times, which makes them almost recession-proof.

Sin stocks also tend to be undervalued at times because institutional investors and analysts tend to shy away from them, even though they often outperform the broad market in the long run. As unpleasant as it may seem, the fact is, sin stocks are usually sound investments.

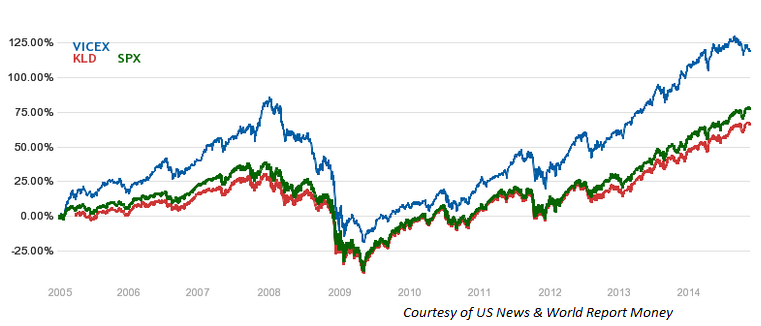

This last point is clearly illustrated in the chart above, which tracks the 10-year historical performance of The Barrier Fund (VICEX) — formerly The Vice Fund — which only holds sin stocks. The blue line plots the fund’s performance against both the S&P 500 Index (^GPSC), in green, and the iShares MSCI USA ESG (KLD) Select Fund, in red, which only invests in socially responsible companies. It is easy to see that over the last decade sin stocks have dramatically outperformed both.

Using moral or ethical criteria to analyze a market of stocks that doesn’t recognize either can hinder your ability to put together a winning portfolio.

Even when a large scale tragedy is linked to a specific type of sin stock, it rarely keeps them down. For example, in the aftermath of the Sandy Hook Elementary School shooting in December of 2012, Smith & Wesson shares fell 23 percent in a matter of days. But just two months later, it had regained all its losses and in a little over six months was hitting 52-week highs.

All investors have the right to decide which stocks they want to buy and which ones they want to avoid, but at the end of the day, investing is about making money. Using moral or ethical criteria to analyze a market of stocks that doesn’t recognize either can hinder your ability to put together a winning portfolio.

When you avoid buying a sin stock it doesn’t affect the company in question and ultimately is an empty gesture. Instead, why not “use” those sin stocks and create some good? A strategy that — when warranted — takes advantage of their earnings power and historical performance can be a way to improve your profits, which you can then take a portion of and donate to charities or causes you believe in.

Brian Lund has developed a list of “20 Books Every Investor Should Know About.”

Permalink | Email this | Linking Blogs | Comments

Source: Investing