Filed under: Investing

ConAgra Foods shareholders have had a hard time stomaching its earnings and outlook statements in the last couple of years. The company has disappointed across all of its segments, and its acquisition of Ralcorp has been fraught with unexpected difficulties. With that said, the stock now stands at a valuation discount to peers like Treehouse Foods and Kraft Foods , but does this make it the value play in the sector? It’s time to look more closely.

ConAgra Foods in charts

Sometimes a chart tells you a lot of what you need to know about a stock. For example, ConAgra’s price chart reveals that after every disappointing earnings report, the value hunters move in on the expectation that it will sort out its difficulties in due course.

Unfortunately, the latest setback has taken the stock price almost back to where it was in February when it last guided expectations lower. However, don’t be surprised if the value players and activist investors start sniffing around the stock, because on a relative value basis, the stock is starting to look cheap.

ConAgra’s acquisition of private-label food company Ralcorp is intended to enable the company to sell both branded and private-label foods into its customer base. The idea is that ConAgra can generate synergies in the process and take advantage of offering a range of products to the same retailers. With this in mind, Fools should keep an eye on its valuation versus Kraft (branded foods) and Treehouse Foods (primarily a private-label company).

Enterprise value (market cap plus debt) to free cash flow is used, because ConAgra took a $681 million non-cash impairment charge in the recent fourth quarter, which reduced its net income for the full year to just $315 million. In addition, ConAgra, Treehouse, and Kraft all contain significant, but varying, amounts of debt.

CAG EV to Free Cash Flow (TTM) data by YCharts.

There is no doubt that ConAgra looks like a good relative value, but is it?

ConAgra Foods growing slower than Kraft and Treehouse Foods

There are two related issues here.

First, Kraft Foods is forecast to grow EPS by 22% and 8% in its next two years, while analysts have Treehouse Foods growing EPS by 13% and 11% over the same period. However, the latest downgrade to expectations sees ConAgra’s management guiding the market toward mid-single-digit growth in 2015, and high-single-digit growth in 2016.

Second, even if Fools accept the trade-off of a cheap valuation for lower growth prospects, they will still have to believe in ConAgra’s guidance — given trading conditions in recent times, that is no sure thing.

What’s going wrong with ConAgra?

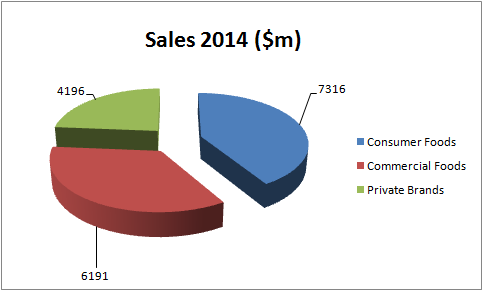

The company reports out of three segments, with its private-brands business largely comprised by Ralcorp. A quick look at the sales split for 2014 reveals the relative importance of each segment.

Source: ConAgra Presentations.

Unfortunately, ConAgra has had issues with all three segments in the last year. The good news is that conditions look set to improve in its commercial foods segment. Last year, the segment was hit with a poor potato crop at Lamb Weston (frozen potato products within the commercial foods segment) and the loss of a major contract. These issues have taken time to work through, but management is now forecasting “good sales and profit growth, led by stronger performance in our Lamb Weston business driven by international growth, and improved margins from a better potato crop beginning in the second quarter” for the segment in 2015.

On a less positive note, the ongoing decline at its consumer foods segment is worrying. The company previously highlighted its Chef Boyardee, Healthy Choice, and Orville Redenbacher brands as areas of weakness, and their problems continued into the fourth quarter. Consumer foods sales declined 7% with a 7% decline in volume. The company has tried product & packaging initiatives and making in-store promotions. Nothing seems to have worked, and it wasn’t surprising to hear analysts asking on the conference call whether management might want to make a “strategic review on the portfolio.”

Furthermore, the Ralcorp acquisition has proved problematic, with ConAgra being forced to make pricing concessions in order to retain business with retailers. These issues should not come as too much of a surprise because Treehouse Foods has had to make restructuring activities in order to deal with shifts in consumer spending patterns in recent years. Ultimately, ConAgra appears to have underestimated the restructuring necessary with Ralcorp, and has spent the last year firefighting to deal with issues. In the words of ConAgra’s president of private brands, Paul Maass: “Integration itself was challenging; and when you have a situation where your customers are really motivated to change suppliers, because we are letting them down on service and execution issues, you got to really pull the price lever to maintain the volumes.”

What should Fools do next?

If you are a believer in relative value within a sector, then there is a case for picking up ConAgra, because it looks relatively cheap compared to Treehouse and Kraft. Moreover, many of its issues — although ongoing — seem to be about internal execution, rather than purely end-market driven. Similarly, the company may well yet decide to sell off some underperforming consumer brands, and raise cash to focus on the private-label business.

On the other hand, the stock doesn’t look screamingly cheap enough on an absolute valuation basis (see charts above) in order to compensate for the ongoing deterioration in performance in its consumer foods and private brands segments. Worse, if the market falls out of love with the food sector, then Fools can’t even rely on a relative value argument. ConAgra has a long road ahead of it.

Top dividend stocks for the next decade

The smartest investors know that dividend stocks simply crush their non-dividend-paying counterparts over the long term. That’s beyond dispute. They also know that a well-constructed dividend portfolio creates wealth steadily, while still allowing you to sleep like a baby. Knowing how valuable such a portfolio might be, our top analysts put together a report on a group of high-yielding stocks that should be in any income investor’s portfolio. To see our free report on these stocks, just click here now.

var FoolAnalyticsData = FoolAnalyticsData || []; FoolAnalyticsData.push({ eventType: “ArticlePitch”, contentByline: “Lee Samaha”, contentId: “cms.136991”, contentTickers: “”, contentTitle: “Is It Finally Time to Buy ConAgra?”, hasVideo: “False”, pitchId: “787”, pitchTickers: “”, pitchTitle: “”, pitchType: “”, sfrId: “” });

The article Is It Finally Time to Buy ConAgra? originally appeared on Fool.com.

var ord = window.ord || Math.floor(Math.random() * 1e16);

document.write(‘x3Cscript type=”text/javascript” src=”http://ad.doubleclick.net/N3910/adj/usdf.df.articles/articles;sz=5×7;ord=’ + ord + ‘?”x3ex3C/scriptx3e’);

Lee Samaha has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 – 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.

(function(c,a){window.mixpanel=a;var b,d,h,e;b=c.createElement(“script”);

b.type=”text/javascript”;b.async=!0;b.src=(“https:”===c.location.protocol?”https:”:”http:”)+

‘//cdn.mxpnl.com/libs/mixpanel-2.2.min.js’;d=c.getElementsByTagName(“script”)[0];

d.parentNode.insertBefore(b,d);a._i=[];a.init=function(b,c,f){function d(a,b){

var c=b.split(“.”);2==c.length&&(a=a[c[0]],b=c[1]);a[b]=function(){a.push([b].concat(

Array.prototype.slice.call(arguments,0)))}}var g=a;”undefined”!==typeof f?g=a[f]=[]:

f=”mixpanel”;g.people=g.people||[];h=[‘disable’,’track’,’track_pageview’,’track_links’,

‘track_forms’,’register’,’register_once’,’unregister’,’identify’,’alias’,’name_tag’,

‘set_config’,’people.set’,’people.increment’];for(e=0;e<h.length;e++)d(g,h[e]);

a._i.push([b,c,f])};a.__SV=1.2;})(document,window.mixpanel||[]);

mixpanel.init(“9659875b92ba8fa639ba476aedbb73b9”);

function addEvent(obj, evType, fn, useCapture){

if (obj.addEventListener){

obj.addEventListener(evType, fn, useCapture);

return true;

} else if (obj.attachEvent){

var r = obj.attachEvent(“on”+evType, fn);

return r;

}

}

addEvent(window, “load”, function(){new FoolVisualSciences();})

addEvent(window, “load”, function(){new PickAd();})

var themeName = ‘dailyfinance.com’;

var _gaq = _gaq || [];

_gaq.push([‘_setAccount’, ‘UA-24928199-1’]);

_gaq.push([‘_trackPageview’]);

(function () {

var ga = document.createElement(‘script’);

ga.type = ‘text/javascript’;

ga.async = true;

ga.src = (‘https:’ == document.location.protocol ? ‘https://ssl’ : ‘http://www’) + ‘.google-analytics.com/ga.js’;

var s = document.getElementsByTagName(‘script’)[0];

s.parentNode.insertBefore(ga, s);

})();

Read | Permalink | Email this | Linking Blogs | Comments

Source: Investing