Filed under: Company News, Industry News, Automotive Industry, Investing, This Built America

It’s hard to predict the future. But sometimes, it’s not too hard to see certain trends emerging. Looking at the auto business as 2015 begins, this might be one of those times. Here are three stories that look likely to unfold this year.

Prediction 1: U.S. Auto Sales Will Remain Strong

This one is almost a no-brainer — almost in the sense that nearly everyone in the auto industry seems to think that the good times for U.S. auto sales will continue rolling in 2015.

But some pundits outside of the industry have forecast doom and gloom, with talk of bubbles fueled by a rise in subprime auto lending — yes, that scary word.

Risky lending practices might be a concern, but car loans turn out not to be that risky for a bank — after all, a car is much easier to repossess and sell than a house.

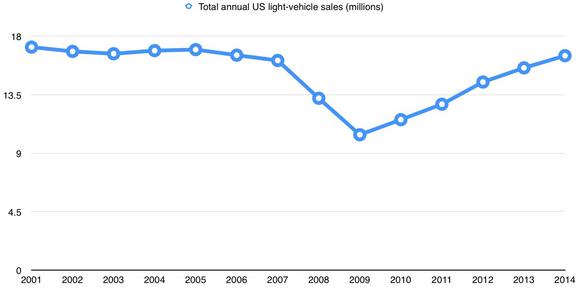

But more important, there’s no evidence that last year’s strong sales results were a bubble. In fact, if you look at the annual results going back to the beginning of the millennium, 2014’s high-seeming level of auto sales doesn’t look so much like a bubble as it does a return to pre-recession normal.

Given the still-improving economic indicators in the U.S. — not to mention the big drop in the price of gasoline — it should be no surprise to see U.S. auto sales maintain, or even improve on, the very healthy pace we saw in 2014.

Prediction 2: Get Ready for a Pickup-Truck Price War

The key model in America’s best-selling vehicle line — Ford’s (F) F-150 pickup — is all-new for 2015. It has a host of new features, including its much-talked-about aluminum body panels, and so far the new trucks have been selling almost as soon as they arrive at dealer lots.

One of Detroit’s most hallowed commandments is: Thou shalt mess with thy competitors’ new-product launches.

Early demand for the new trucks looks to be very strong. So Ford should be able to roll back its incentives and count its profits in 2015, right?

Not so fast. One of Detroit’s most hallowed commandments is: Thou shalt mess with thy competitors’ new-product launches.

The 2015 F-150 is the newest entry in the segment, and typically, that means it should see the strongest demand. But in this case, rivals aren’t that far behind: General Motors’ (GM) Chevy Silverado and GMC Sierra were all-new just last year, and Fiat Chrysler’s (FCAU) well-reviewed Ram was refreshed just a year earlier.

That means that both GM and Fiat Chrysler are in a great position to compete aggressively with the new Ford. And history suggests that they will.

Shortly after GM launched its new pickups, we saw Ford and Chrysler step up their advertising and boost their incentives to try to steal some of the new trucks’ thunder. It worked: Early sales of the new GM trucks were subdued, and GM ended up having to boost its incentives to match rival offers.

Another of Detroit’s commandments is: What goes around, comes around. Expect GM (and Fiat Chrysler) to do its very best to undermine the early sales momentum of Ford’s new truck. That may give Ford executives headaches, but it’ll be great for consumers.

Prediction 3: Sales of Some Plug-In Models Will Stall — but Not All

The big drop in gas prices comes at a tough time for those hoping for a greener automotive future. More and more plug-in hybrids and fully electric cars are coming to market, but they still come with price premiums and other compromises.

With gas closer to $2 than $4 (or even below $2 in some places), those premiums and compromises become harder for buyers to swallow. Suddenly, a midsize sedan that gets 30 miles per gallon seems completely reasonable, and a plug-in alternative seems like an overpriced hassle.

That has already started to hurt sales: Sales of Ford’s Fusion hybrid (including the plug-in Energi version) fell 16 percent in the fourth quarter of 2014, while Toyota’s (TM) vaunted Prius lineup saw sales drop 11 percent for the year.

But not all electric cars are expected to suffer: Analysts think that Tesla Motors’ (TSLA) Model S will continue to do well no matter what happens to gas prices — and Tesla could even see a boost late in the year, when its Model X SUV is expected to begin shipping.

Motley Fool contributor John Rosevear owns shares of Ford and General Motors. The Motley Fool recommends Ford, General Motors and Tesla Motors. The Motley Fool owns shares of Ford and Tesla Motors. Try any of our Foolish newsletter services free for 30 days. Find out the easy way for investors to ride the new mega-trend in the automotive industry in our free report.

Permalink | Email this | Linking Blogs | Comments

Source: Investing